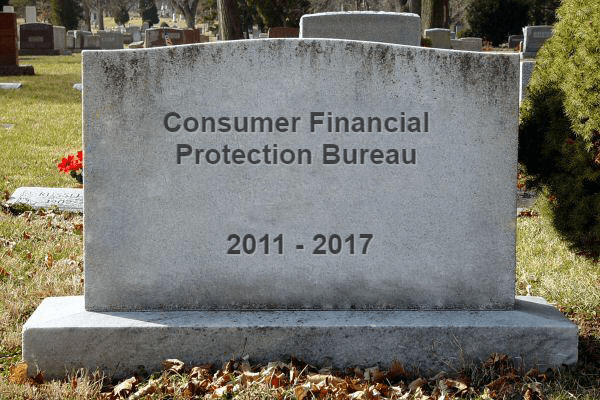

The results of the November presidential election shocked the world, leaving many to wonder what the future will hold when President-Elect Donald Trump eventually assumes the role of President. With his administration nearly assembled, experts are predicting that many of his key picks are a clear sign that the Consumer Financial Protection Bureau (CFPB) is marked for death.

In the wake of the financial crisis, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2011. This piece of legislation was a response to the worst economic crisis America faced since the Great Depression, when millions of Americans lost their homes, savings, and jobs due to a lack of financial oversight.

Dodd-Frank created the CFPB, an agency designed to shield consumers and stand up to unscrupulous organizations that operated largely unchecked. In the 5 years since its creation, the CFPB has:

- Set new standards for the mortgage market

- Prevented most lenders from offering loans that borrowers are unable to reasonably repay.

- Uncovered the full extent of the Wells Fargo fake account fraud, and fining the bank $100 million

- Handled over 900,000 complaints and recovered $11.7 billion in compensation to consumer victims of deceptive and fraudulent practices.

- Stood up for consumers against predatory lenders

- Drawn a hard line on forced arbitration

- Helped to inform consumers about responsible financial decisions and defend them from harmful practices

The CFPB accomplished a great deal in a short amount of time largely due to how it is structured. Designed to be a centralized entity for consumer protection, Director Richard Cordray was able to wield his power with a level of autonomy that most other regulatory agencies could only dream of. This meant the CFPB could swiftly and effectively protect consumers, but it also made them a very large target.

In October 2016, the United States Court of Appeals for the D.C. Circuit court found the structure of the CFPB to be unconstitutional. The court particularly took issue with other arms of the government being unable to question or impede the Bureau’s actions. Given that Cordray was only loosely accountable to the President – and only removable from his position for good cause – it wasn’t a hard argument to make. In the end, the court decided to call for the Bureau to be restructured so that the President could remove the director at will.

Many have taken this decision as a sign of things to come. With several members of the new administration having previously stated their desire to repeal the Dodd-Frank act that created the CFPB, there is definitely reason for concern. If the new administration manages to cripple or outright kill the CFPB, then millions of Americans would suddenly find themselves without some critical protections.

You Want a Jury to Hear Your Case? No, You Gave Up that Right.

We’ve talked a lot about mandatory arbitration clauses, and for good reason: it’s an incredibly important issue. Basically, arbitration clauses state that when you use a product or service, you give up the right to a trial if you have a grievance with the company behind the product or service. Instead, your only option is an out-of-court proceeding overseen by a third-party arbiter.

So what’s the problem as long as someone hears your case? In addition to arbitration being generally skewed toward those who control the process, it typically comes with mandatory confidentiality agreements. If you or a loved one was seriously wronged by a company, like if a nursing home was abusing your mother, or if a bank used your information to open dozens of fraudulent accounts, the only people who will know about it are you, the arbitrator, and the company.

Mandatory arbitration clauses prevent people like you or me from seeking justice in the light of day, and let companies hide their guilt behind closed doors.

Did You get Taken in by a High Interest Short Term Loan? Too bad!

Auto title loans, payday loans, and the like prey on people who need money quickly by marketing themselves as convenient and dependable. In reality, the often absurdly high interest rates mean that customers can end up repaying far more than mainstream loans. Without the CFPB safeguards, lenders would be able to continue preying on customers, driving them further into debt.

Want Someone to Hold Large Corporations Accountable? Not a Chance!

Does it make you angry when you see a story about corporate executives flying a private jet to ask for taxpayer money, or when an executive is forced to leave his company amid a scandal and walks away with a $125 million golden parachute?

It should make you angry. But without the CFPB as a safeguard to keep businesses in check, you may be in for a lot more of these stories.

Whatever your political stance is, protecting ourselves from corporate abuse is a bipartisan issue. If the time comes that the CFPB is on the chopping block, don’t turn a blind eye. You may not need it every day, and if you’re lucky you may never need it. But if that day does come, you will wish you had the CFPB looking out for you.

Disclaimer: This article has been prepared for general information purposes and does not constitute legal advice, nor does it imply an attorney-client relationship or contract with Wexler Wallace.

0 Comments